-

Posts

233 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by DiamondbackFan

-

"A new six-story hotel tower in front of the current hotel building, facing Kings Island Drive. The hotel will have 24 three-bedroom suites and be connected to the existing hotel. The hotel will be 75 feet tall, as tall as the waterpark, and will be visible from Kings Island Drive. Removal of 55 parking spaces to make room for the new tower."

-

Which Six Flags parks are up for sale?

DiamondbackFan replied to Orion-XL200's topic in Other Amusement Parks & Industry News

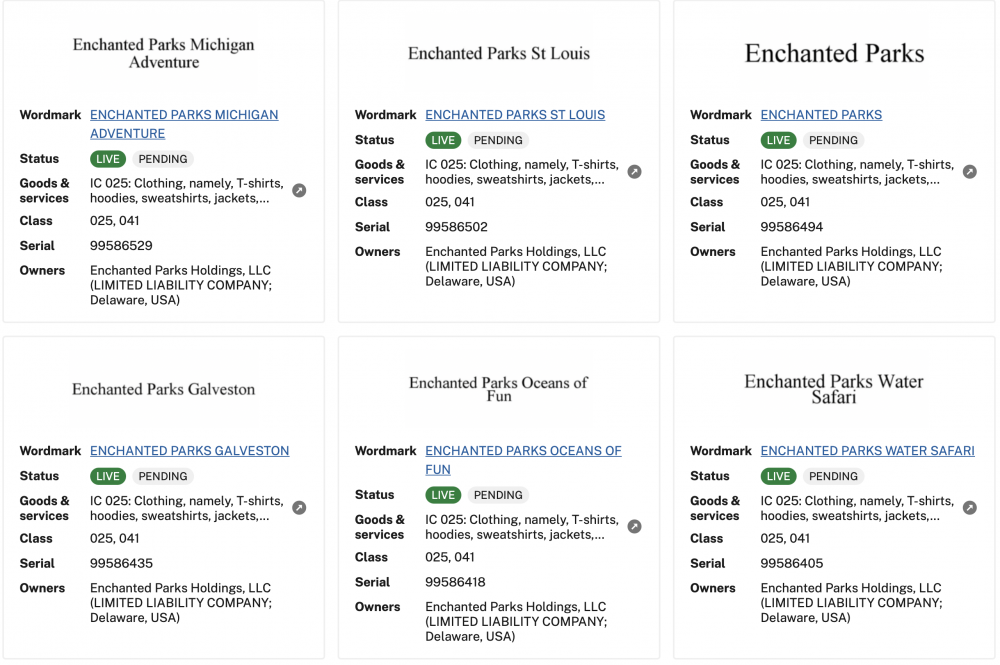

Some new trademark applications by Enchanted Parks. (see attached image) EDIT: Found a trademark for Enchanted Parks Great Escape Lodge. This appears to be a park sale to Innovative Attraction Management and they are rebranding these parks and the parks in Old Forge, NY that they purchased in 2024 to the Enchanted Parks brand. -

They buy time, but are replacing 2027 Notes at 5.375% and 5.5% interest with one at low-to-mid 9% interest. From Bloomberg: "Six Flags Entertainment Corp. is planning to sell $1 billion of dollar bonds in the riskiest tier of the junk market, testing investor appetite for the second such deal this week with CCC ratings. The US amusement park operator is offering the six-year notes at low-to-mid 9%, with the proceeds earmarked to refinance debt due next year, according to a person with knowledge of the matter." https://www.bloomberg.com/news/articles/2026-01-06/park-operator-six-flags-taps-market-for-1-billion-in-junk-debt

-

Six Flags will probably opt to renew or extend the the Texas Partnership and still has majority ownership of the Texas partnership. By declining the buyout, they can avoid taking on another $344.2 million in debt to pay for the buyout. The End-of Term Option from the last quarterly report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001999001/6109e747-0c95-451d-91e6-6687f18de9f3.pdf

- 1 reply

-

- 2

-

-

Six Flags Names New CEO

DiamondbackFan replied to DonHelbig's topic in Other Amusement Parks & Industry News

This is such a bad take. You might want to do some research on John Reilly and what he accomplished while he was at SeaWorld Parks and Resorts and Palace Entertainment/Parques Reunidos. -

Six Flags and Cedar Fair Merge

DiamondbackFan replied to IndyGuy4KI's topic in Kings Island Central Newsroom

We might get a new CEO announcement soon. https://finance.yahoo.com/news/jana-partners-provides-six-flags-131500178.html "NEW YORK, Nov. 13, 2025 /PRNewswire/ -- JANA Partners LLC ("JANA"), which along with its partners collectively own an economic interest of approximately 9% in Six Flags Entertainment Corporation (NYSE: FUN) ("Six Flags" or the "Company"), today announced that Dave Habiger has de-grouped from the JANA-led investor group to enable him to pursue a complementary opportunity involving the Company." -

Six Flags and Cedar Fair Merge

DiamondbackFan replied to IndyGuy4KI's topic in Kings Island Central Newsroom

https://finimize.com/content/activist-investors-shake-up-six-flags-entertainments-boardroom https://investors.sixflags.com/news/press-releases/press-release-details/2025/Six-Flags-Appoints-Jonathan-Brudnick-to-Board-of-Directors/default.aspx -

They probably couldn't find a buyer for these parks that wanted to operate them and will sell them for the land value. Herschend had to buy all of the Palace parks as a package, now they are unloading the parks they don't want. The Boomers parks in California, Castle Park, Raging Waters Los Angeles, and Wet 'n Wild Emerald Pointe were sold to Lucky Strike Entertainment. The Cartoon Network Hotel is dropping the license and being remodeled and rebranded to Dutch Wonderland Inn.

-

Six Flags and Cedar Fair Merge

DiamondbackFan replied to IndyGuy4KI's topic in Kings Island Central Newsroom

Activist investor, Land & Buildings, is pushing the company to sell off the land under the parks again. They sent out a letter to shareholders today. https://www.businesswire.com/news/home/20250925248557/en/Land-Buildings-Issues-Letter-Detailing-Why-Now-Is-the-Time-to-Finally-Unlock-Six-Flags-Substantial-Trapped-Real-Estate-Value -

Six Flags and Cedar Fair Merge

DiamondbackFan replied to IndyGuy4KI's topic in Kings Island Central Newsroom

It sounds like that is part of the plan. Non core parks they own: Six Flags St. Louis, Six Flags Discovery Kingdom, Six Flags Great Escape, Valleyfair, Worlds of Fun, Michigan's Adventure, Schlitterbahn New Braunfels. La Ronde is a ground lease and Six Flags could sell all of the rides and operating rights there. -

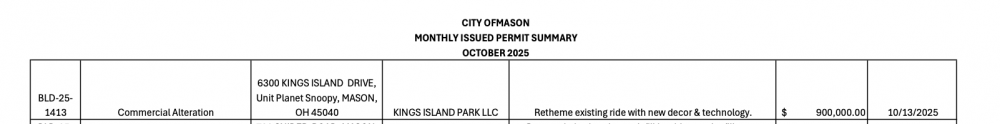

Kings Island to add “family thrill” attraction in 2026

DiamondbackFan replied to BoddaH1994's topic in Kings Island

Ride Entertainment Systems Inc was on the last notice of commencement and they work with Lagotronics Projects. https://ohwarren.fidlar.com/OHWarren/AvaWeb/#/image https://www.lagotronicsprojects.com/en https://rideentertainment.com/lagotronics/ -

You can take the Canada's Wonderland 2026 project off the board. Six Flags 2026 capex is being reduced to $400 million. On the earning call, Zimmerman hinted at this project being delayed or cancelled because they don't think they have gotten the full benefit from the 2025 capex yet. Canada's Wonderland attendance is way up since AlpenFury opened and the coaster is a massive success.

-

Valleyfair https://www.facebook.com/ValleyfairMN/posts/pfbid02BQZE9QBUf9gn7tGWaV8zwycNuCPcYuPrC9w7AycE2zZsmtEkCJzXsRE2bYCo5Zvtl #SomethingSuperior26 New waterpark adventures are coming to #Valleyfair in 2026. We're also celebrating our 50th anniversary. With that in mind, a portion of #SoakCity will close after August 10 to begin construction. Visit before then to ride these favorites one last time: Hurricane Falls Panic Falls Body & Speed Slides Ripple Rapids Splash Station The rest of Soak City will remain open through Labor Day.

-

Six Flags and Cedar Fair Merge

DiamondbackFan replied to IndyGuy4KI's topic in Kings Island Central Newsroom

More coaster removals coming soon? https://www.sixflags.com/greatamerica The sale says 280 coasters, but RCDB lists 294 operating coasters at SFEC (SBNO and Under Construction are not in the count) https://rcdb.com/12488.htm 294 coasters -9 coasters at SFA = 285 coasters +4 2026 additions (SFNE, SFMM, SFM, SFOT) = 289 coasters +1 Pantherian at KD = 290 coasters +1 Montezooma's Revenge - The Forbidden Fortress at Knott's = 291 coasters +2 SBNO coasters that could reopen (Timberwolf at WOF, Flash V2 at SFDK) = 293 coasters -

Kings Island to add “family thrill” attraction in 2026

DiamondbackFan replied to BoddaH1994's topic in Kings Island

The earnings call is Wednesday. -

Kings Island to add “family thrill” attraction in 2026

DiamondbackFan replied to BoddaH1994's topic in Kings Island

The press release for all of the new additions was Thursday August 15th last year. I wouldn't be surprised if they put out the press release on Thursday August 14th this year. -

Six Flags America up for sale in August

DiamondbackFan replied to Oldiesmann's topic in Other Amusement Parks & Industry News

It is being sold for redevelopment. Better info in this video. https://youtu.be/OgMeILBbjq4 Here is the property listing: https://www.cbredealflow.com/handler/modern.aspx?pv=Z-I9J549zUFsSziezRAUlDpkNDIIt7xMO5qE_h7gISzRPnQ5IPCRP7U1-PRJGopf#_top -

The Conjuring House Coming to Kings Island - RUMOR

DiamondbackFan replied to SPONGEBOB_FAN_97's topic in Rumors

From the ParkFans.net bluesky account: https://bsky.app/profile/parkfans.net/post/3ltzgtpopsc2r -

You can search by owner on this site: https://tmsearch.uspto.gov/search/search-information If I post a direct link to the trademark, it will expire after awhile. I think it will just be a new area of the park. There is a new path going from the former Scrambler location to Fury 325 and a new restaurant in the plans.