disco2000

Members-

Posts

4,077 -

Joined

-

Days Won

122

Content Type

Profiles

Forums

Calendar

Everything posted by disco2000

-

Cant wait to hear which soundtrack they went with...and if the fountain show works...

-

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

And of course, Milford's own "If I get Corona..." -

-

-

Watch out boy she'll chew you up (Oh here she comes) She's a maneater (Oh here she comes) Watch out boy she'll chew you up (Oh here she comes) She's a maneater

-

Apparently a meteor hit and knocked out all cellular service

-

Unique ride photo, but I thought the plans showed the ride photo was at the bottom of the first hill, not the 5th

-

-

-

Welcome back Beast riders, how was that ride?

-

They prepared for people thinking they could replenish their stock at home Now if they only had soap in the dispensers

-

When aren't you contemplating Skyline No ice at the Freestyle machines @King Ding Dong

-

Orion just closed....It's normally code 29 when that happens but I thought they just said covid-19 Sounds like it might be down a while....

-

Do we get a side item with the salad this year or not at the shack on the meal plan...I'm in line and it's extended almost to Drop Tower so wanna know if I should bail...

-

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

And yet in 2019 they made what many people called unprecedented weather closures on days they would have stayed open previously... That discussion of people losing confidence in their posted hours started last year... on this forum and on Facebook... -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

I absolutely agree with you the park knows this, but opening and bleeding money and going bankrupt isn't a sustainable business plan either. If they open and a 2020 pass is good for all of 2020 and all of 2021, that has a serious impact on their long term capital expenditures... I'd rather they call the season instead of providing a mediocre experience because they cannot open everything or cut back on stuff and then use that investment to make the park better in the future. Regarding customers, the harsh reality is sometimes companies know they have such a captive audience, or has the ego to believe people will come regardless...what was the Kinzel famous quote "They gotta eat"... Where else local are you gonna go for rides, Coney Island? Nope Coney got rid of their rides. I guess we have Stricker's... This isn't your local lazer tag where there are 20+ of these in the tri-state area that you could spend your money at instead, this is Kings Island with limited local competition for what they offer...Sure you can take your money to a different experience, but not locally for what KI provides...they don't have the monopoly on it, but you have to drive to Louisville or farther to start to get something one would consider a similar experience...people get mad at KI, but they come back...especially if they are a roller coaster junkie.. Plus we are starting to see other places where we could spend our discretionary funds have already called their season - The outdoor theater in Chillicothe, Covington rec center not opening pools this summer...etc. More to come. You mention Cedar Fair competition, so let's look at that. Six Flags would probably be their real competition and they just issued a preliminary Q1 statement/update/press release. Most do not take the time to read investor statements and do research - including a large component of investors...they are long and boring...even longer than my posts , but a wealth of information can be obtained from these reports... These quarterly and yearly statements by publicly traded companies are largely "read between the lines" documents. They have to be truthful, but not to the point of being explicitly stated. The statements have to be able to pass the SEC scrutiny and a lawsuit by a class action group that feels they were misled and invested. Let's take a look at what SIX just said: Since closing its parks in March, the company has taken the following actions to reduce operating expenses: Eliminated nearly all of its seasonal labor costs, and positioned itself to maintain this low level until its parks reopen. Announced a 25 percent salary reduction for all executives and salaried employees and a 25 percent reduction in scheduled hours for all full-time hourly employees to 30 hours per week, subject to federal and state minimum requirements. Suspended all advertising and marketing costs. Intends to eliminate at least $30-40 million of additional non-labor operating costs in 2020, including the increased investments the company announced in its fourth quarter 2019 earnings release to improve the guest experiences. And the most telling statement: As of March 31, 2020, the company had cash on hand of $23 million and, including the revolving credit facility increase, net of $21 million of outstanding letters of credit, had $420 million available under its revolving credit facility. The company expects to have ample cushion under its debt covenants until at least the fourth quarter of 2020, even if the parks were to remain closed. The company has no debt maturities until 2024. At this time, the company believes it has sufficient liquidity to meet its cash obligations until the opening of the 2021 operating season. Those are very telling statements. Reading between the lines, what would be eliminating $40million of non-labor costs and investments announced during Q4 of 2019...Sounds like all new for 2020 will now become all new for 2021...or an awful lot of toilet paper and light bulbs aren't being purchased A savvy investor will read this line "At this time, the company believes it has sufficient liquidity to meet its cash obligations until the opening of the 2021 operating season." and recognize this implies that they may not open this year. It doesn't mean they won't open, but they are also telling investors that they can weather this storm until 2021 if they need to. The SIX park in Canada probably won't open based on latest stay-at-home thru August 31st for example... So if someone dumps all their life savings into SIX stock this month thinking the park will open in May and their stock value would jump and they make money and then SIX doesn't open and the stock dives and said person files a lawsuit claiming they were misled, SIX attorneys could point to this single sentence and center their entire defense around it and supplement it with all the other information they have provided... It will be interesting to see what the FUN Q1 report says... -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

I like your example and is inline with what I have been saying. The one difference however, is your example is whether they open or not based on the ability to hit a revenue target, or as you call it “top line revenue” to meet investor expectations. At this point, trying to meet investors expectations of record revenue and attendance is gone, so CF is not going to look at "top line revenue" as an indicator to try to meet as this will not be a record year on the positive side, so they will simply be looking at minimizing their losses and then bragging about it in their year end report. The fixed costs are a given, so if they can open and if the revenue generated by opening is more than the cost of opening and operating, they will consider it. If it is less, why spend more money to lose even more money...That’s like stepping over a dollar to pick up a dime… In your example, since the variable costs are less than the revenue generated, yes they would consider opening. This is in agreement with what I have previously posted! In my example, the variable costs would be more than revenue generated, in which case they wouldn't consider opening from a financial standpoint. If the money IN is not equal to or more than the money going OUT, they don't open. Same with our own finances. If the wage we make is less than the stuff we want to buy, we don't buy it (now granted loans and mortgages come into play, but even with those one should be taking out loans on what one can afford with monthly payments, not on what one wishes you could afford)...I wish I could have a Lamborghini but I can only afford an Accord...and a 1995 at that... Fact of the matter is, anyone can come on here and come up with infinite "using easy numbers" examples to justify their position whether they will open or not. In most cases, these will be guesses. Some will have rational justifications to support their position while others go with a generic "they will make money on merch sales"... Many of those guesses will be unrealistic or impossible (Knott's losing $500,000 in profit every day they aren't open is an unrealistic example). Some may be close. We really don't know. CF knows their numbers better than anyone. They make an attendance budget for every operating day based on historical information. They know when it would cost more to operate than the revenue generated. They know which days are their money makers and which ones aren’t. Over the course of the season, the days they make money are more than the days they don’t. They now have to weigh into this historical data the uncertainty of the times: How long will the “fear factor” last of people not wanting to be around crowds? Is it a month or 6 months? How much social distancing and other measures will they have to deal with, all with a cost? How much of a "degrading" of the experience will the guest accept to deal with the pandemic? Is it no shows? Is it Haunt without rides? How many of their daily admissions disappear because people have lost their jobs and cannot afford to go to the park this year? How much of their attendance will be season pass holders with meal and drink plans not buying anything else? How many of their company picnics disappear as companies skip on that expense this year? Daily admissions and company outings make up almost 50% of their attendance. If those disappear, where does a large chunk of their "new" revenue come from? Here is an example – let’s assume season pass sales cover all fixed costs. So operating costs comes strictly from their other attendance sources (which makes up roughly half the attendance). If the park opens too late in the year, what if their only attendance is season pass holders with meal and drink plans then where is the "new" operating revenue? The park will not sell enough merchandise from pass holders to pay for operating the entire park. As a business, they know based on historical data when it will cost more to open than the revenue generated. Then they have to take the above into consideration and likely move that date earlier in the year rather than later… Some on this forum or other fan sites think that if they get the all clear in the middle of December they are opening because they will get revenue from merch and t-shirt sales – again certainly not enough to pay for the entire operation; while others think it is July or any other time in between now and end of year or not at all. There is even a poll somewhere going on guessing the month. Someone suggested the park put food tents in the parking lot to let people get park food with their meal plan and sit in the lot in their cars and look at the park skyline while enjoying their park provided Skyline – again that would be an expense to the park with no new income generated. Sounds great from a pass holder perspective, but not a revenue generator from the park perspective… When we look at this from a business perspective and not a season pass holder perspective, the perspective changes... If the season ends up being a wash, I am confident that CF will do plenty of enticements to make the pass holders feel whole. More operating days in 2021, more ERT, more passholder days, etc. and anything else their market research tells them will "keep 'em coming back"... Some on here will take the park in whatever experience they can have it this year (even if that means half the rides shut down or no shows, etc.). Others would rather they skip a year and give them the full experience and more in 2021. Whatever they do, people will complain and will be lining up in the "make me whole department" line...wait wrong park forum again -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

I am sure the accountants* that would have been in line for Orion right now would be discussing the tax accounting practices of CF and wondering which method they employed to write this baby off *If any would have been in line since tax day would have been right around the corner -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

Excellent Beast example! But of course people will say they could sell the wood to enthusiasts...but I still doubt they would sell enough to make it an asset for ride removal versus expense LOL... Yes, they have fixed costs whether the park is open or not...and they are finding ways to reduce that further (cutting full-time hours, reducing marketing costs, etc.). But at some point "Any income gained by opening the park would go against those costs" is not a true statement... Let's for example say fixed costs stay the same. If the park opens, they then have operational expenses (electricity, staffing, marketing, payroll, etc.) that get added on top of fixed costs and that becomes part of the cash input versus cash output equation. Fixed costs stay the same, so if the operational expenses are a larger number than the income generated by opening later in the year, what financial incentive do they have to open this year? If for every dollar they make, it costs them $10 dollars in operating expenses to make that $1, why open? -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

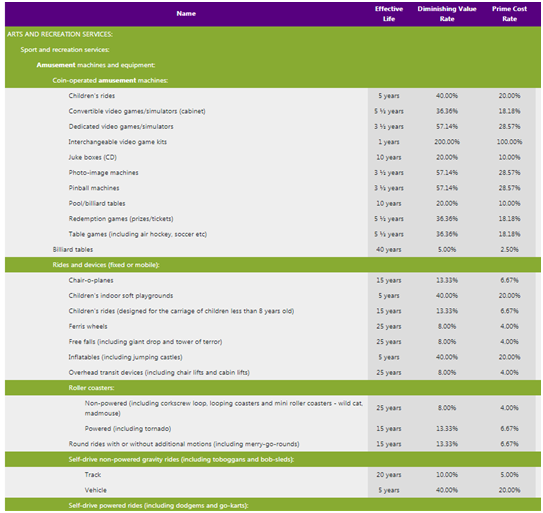

Rides absolutely depreciate for IRS accounting and tax purposes. If you were looking to purchase a park, like The Beach for example, this article explains how from a tax purpose you would go about allocating value of rides, land, etc....plus how the selling price is generated...If you want more information, refer to IRS publications... What is costs to build now is much different than the salvage value...Market value would be essentially close to salvage value. It would be the price someone is willing to pay to buy it from a park, which is why Vortex and Firehawk were scrapped. Now the marketing value a ride brings to the park is different and one cannot interchange the rides cost (actual or salvage price) with the marketing value a ride brings to a park. Here is an example depreciation table. While this table shows a steady % spread over each year of it's effective life (which may or may not be the same as the number of years the ride operates), there are so many tax regulations that a good accountant will absolutely use the Modified Accelerated Cost Recovery System (MACRS), which is a tax depreciation system allowed in the United States, to provide their employer or client with the best tax rate available (this basically depreciates it heavier on the front end and usually accelerates the asset value faster like in 7-10 years, so it could depreciate 20% in it's second year..): -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

I thought this was telling and also was applicable to this thread....CF should be having a Q1 statement soon as well that should provide some additional thoughts on where their thinking is.... -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

While it’s true that younger people are less likely to die from the illness, if they are admitted to the hospital they will likely require ventilators and evidence has shown those that need a ventilator, regardless of age, are showing signs of lung damage... My neighbors niece is in her 20s, non smoker or vaper, had covid and has been in hospital for several weeks. Still on oxygen. Doctors say she has lung damage. -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

How many people over 50 do you know that vape? https://www.google.com/amp/s/time.com/5807214/vaping-coronavirus/%3famp=true -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

Speaking of stats, The NHTSA reports that approximately 52 percent of all accidents occur within a five-mile radius of home and 69 percent of all car accidents occur within a ten-mile radius from home, so I moved -

Coronavirus Impacting Theme Parks

disco2000 replied to Hawaiian Coasters 325's topic in Kings Island

While I certainly think you are right, it really is an unknown and changes every day with every new data point. Time will tell as we start to loosen restrictions and evaluate and see what happens and reassess the data. Could you have imagined on January 1st that you would end your school year remote learning...oh wait wrong example for you Seriously though, nobody predicted on January 1 that we would be experiencing all we are experiencing, and because of this uncertainty, who knows what may happen the next three months....